Get a step ahead of the unexpected

Personal lines of insurance are your first lines of defense for shielding you and your family from the potentially devastating financial impact of unexpected events. From Homeowners and Auto Insurance to Life and Umbrella coverage, Alera Group’s licensed specialists can help you create a customized, cost-effective insurance program to safeguard both your possessions and your finances. More importantly, because we are an independent insurance brokerage, we compare policies from multiple carriers, so you get the best coverage at the best rate for your needs.

Protect the world you’ve built

You’ve invested a lot in building your life. Don’t leave it to chance. Alera Group helps you protect that world — and all the things in it — with policies tailored to your unique needs and situation.

Automobiles

Automobile insurance is crucial for protecting you from financial loss arising from accidents, theft and damage to your vehicles — including collector, classic and recreational types. It typically includes liability, collision and comprehensive coverage to safeguard your financial wellbeing.

Domestic Employee Workers' Compensation

This type of insurance covers workers in your home — such as health aides, nannies, housekeepers and gardeners — in the event of an accident or injury while on the job. It helps protect you from financial liability and ensures compliance with state labor laws.

Home

Homeowners Insurance is essential for protecting your structure and assets from damage caused by fire, theft, weather events and other perils. It typically includes coverage for the structure of your home, personal belongings and liability.

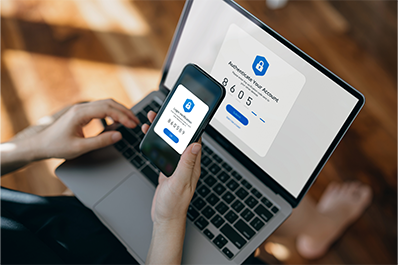

Identity Fraud

Identity fraud protection provides the support you need to recover from the nightmare of identity theft. It covers expenses related to restoring your identity, such as legal fees and credit monitoring.

Personal Cyber Security

Personal Cyber Security Insurance, also known as “Cyber Liability Insurance” and “Cyber Risk Insurance,” protects your digital life and assets from financial loss resulting from cybercrime — including cyberattack, cyberbullying and cyberextortion — as well as data breaches and online fraud.

Travel Accident

Travel worry-free knowing you're protected in case of injury or death. Travel accident coverage acts as Life Insurance regardless of, and in addition to, other insurance coverages.

Umbrella

An umbrella insurance policy goes beyond your standard Home and Auto Insurance to provide extra protection against large liability claims that could threaten your assets. With increased coverage comes increased peace of mind.

Fine Art and Jewelry

Protect your treasures with coverage for valuable property such as jewelry, fine art and collectibles. Your valuables will be covered from loss, theft and damage, allowing you to rest easy knowing your assets are protected.

Yachts and Boats

Protect your personal watercraft investment, such as a boat or yacht, with coverage aimed at potential damage to or loss of your recreational vessel. Your policy also protects you from legal liability due to the ownership or operation of the watercraft.

Recreational Vehicles (RVs)

Whether you use your recreational vehicle part-time or as a permanent residence, you want to protect your investment. RV coverage helps safeguard motorhomes, snowmobiles and other recreational vehicles against damage, theft and liability both on and off the road.

THOUGHT LEADERSHIP

Insights

Property and Casualty

Top 5 Insurance Surprises Businesses Face in Q4 — and How to Prevent Them

As year-end approaches, many organizations focus on closing out financials and planning for the year ahead. It’s also the time when insurance programs often reveal unexpected challenges, some avoidable, others the result of shifting market conditions or overlooked details.

October 30, 2025

Find out moreProperty and Casualty

Alera Group’s 2025 Property and Casualty Market Update

Alera Group’s 2025 Property and Casualty Market Update, designed as a bridge between Alera Group’s annual Market Outlooks — provides insight into pricing, coverage availability, market capacity and underwriting trends for the balance of 2025.

August 1, 2025

Find out moreProperty and Casualty

Severe Weather Is Getting Worse. Is Your Business Interruption Insurance Keeping Up?

The increasing frequency and severity of weather- and climate-related events such as catastrophic storms, floods and wildfires make business continuity planning more important than ever. Part of your plan should include reviewing your organization's Business Interruption Insurance coverage.

May 5, 2025

Find out moreProperty and Casualty

The Role of Risk Management in Public Sector Insurance

Public sector organizations increasingly find themselves in an environment of shrinking budgets, staffing shortages, growing hostility and rising inflation.

May 31, 2022

Find out more