Property and Casualty

It’s Here! — Alera Group’s Fifth Annual 'Property and Casualty Market Outlook'

December 12, 2024

For the fifth consecutive year, Alera Group is proud to present our Property and Casualty Market Outlook, a comprehensive guide to making informed decisions on customized, cost-effective insurance coverage for you and your business.

What’s especially gratifying about releasing the 2025 Market Outlook is the amount of encouraging news it includes — specifically that the market has stabilized significantly, with rate increases leveling off for certain lines of business, some carriers expanding capacity, and alternative insurance solutions becoming increasingly viable for midsize organizations as well as large companies.

Which isn’t to say all the news in the Market Outlook is good …

Challenges ahead

As anyone who owns real estate in a catastrophe-prone area knows, Property Insurance can be especially challenging, with some major carriers having pulled out of the Property market altogether in sections of California, Florida, Louisiana and other areas susceptible to wildfires, hurricanes, flooding and other natural disasters.

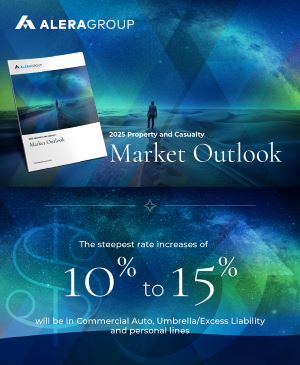

Commercial Auto Insurance and personal lines of insurance in general remain challenging as well, with rate

increases of 10%-15% expected in those lines of business. Multiple factors are behind the Commercial Auto increases, including repair costs, the frequency and severity of claims, and the ongoing rise of litigation awards — sometimes known as nuclear verdicts — in liability lawsuits.

Informed decision-making

Understanding the causes of market conditions is vital to anticipating challenges, managing risk and devising solutions — and that’s a big part of what’s made Alera Group’s annual Property and Casualty Market Outlook such a respected publication in the insurance industry and among other business leaders. But we don’t stop there.

The report is extensive and thorough, analyzing the market by line of business and by industry. For each line of business, we examine not only rates but also availability of coverage, capacity carriers are willing to take on and the amount of underwriter scrutiny buyers can expect. Our industry-by-industry sections detail conditions for all the most relevant coverages, such as Commercial Auto, Cyber Liability, Professional Liability, Umbrella/Excess Liability, Workers’ Compensation and many more.

For an at-a-glance synopsis of the Property and Casualty Market Outlook, view our infographic (excerpt at right).

You’ll also find a section readers have found invaluable regardless of industry: “Strategies for Navigating the Market.” This is where the rubber meets the road: eight steps for taking the information presented in the Market Outlook and using it to design and implement the insurance and risk management program necessary to achieve continued growth and profitability.

Collaborative Effort of Industry Experts

Alera Group is built on a culture of collaboration — among colleagues, between brokers and clients, and with other service providers who share our goal of delivering the best possible solutions to meet each client’s needs and objectives.

Our Property and Casualty Market Outlook embodies that culture of collaboration. Based on our third-quarter survey of Alera Group subject matter experts, our insurance company partners and wholesale intermediaries, the report delivers current perspectives and guidance from the best in the business. We’re very pleased to present it to you. And we look forward to working with you in 2025!