Wealth Services

Monthly market update | October 2023

November 8, 2023

Current market and economic conditions

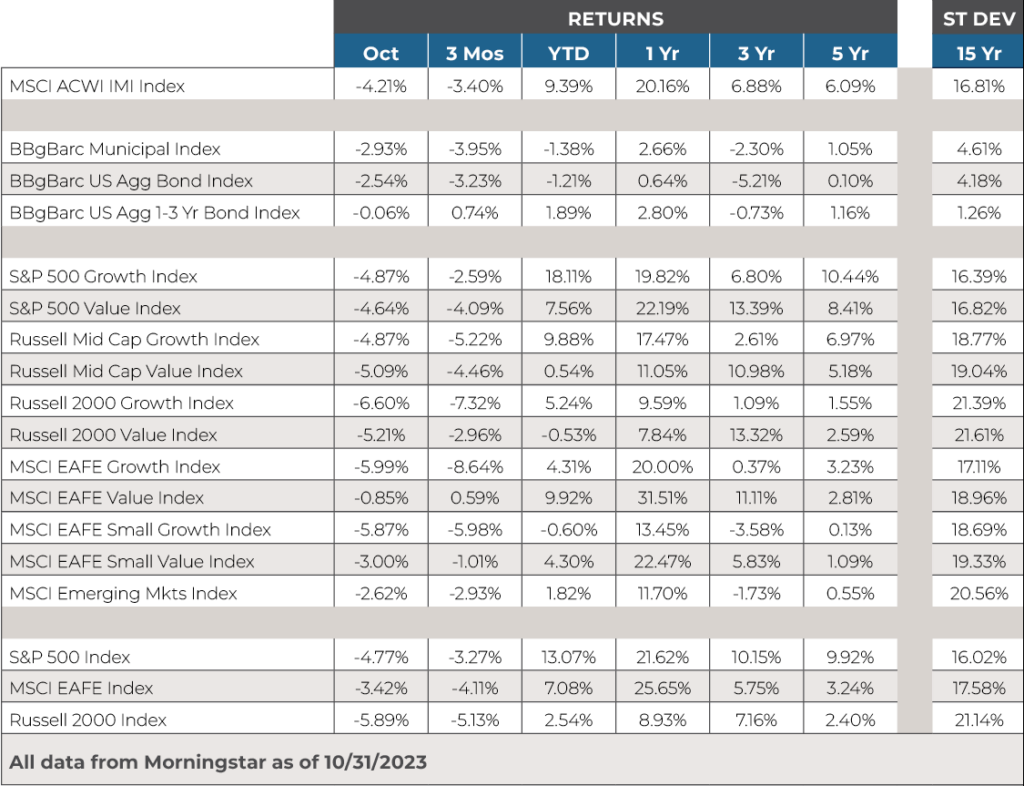

- In October, the S&P 500 Index was down 2.17%, while the Bloomberg Barclays US Aggregate Bond Index was down 1.57% and the Bloomberg Barclays Municipal Bond Index was down 1.25%.

- The stock market in October continued the correction started in August. However, toward the end of the month, market sentiment began to anticipate the Federal Reserve ending the cycle of Fed Funds Rate increases. This may signal a turning point for the stock and bond markets.

- The bond market also began to reverse course. After peaking in mid-October at 4.98%, the 10-year Treasury yield began to fall.

Bond market

- “The economy just won’t slow down, and it’s the worst possible news for the markets right now” was a business headline as October began. If you ever wondered what the phrase “good news is bad news” means for the markets, that headline sums it up. Basically, the markets feared that if the economy continued to grow “too quickly,” it would cause the Federal Reserve to continue to raise interest rates. The “relief” for the markets has been, that despite the incredible GDP growth rate during the third quarter of 4.9%, significant indicators such as wage growth and inflation numbers were trending in the right direction for the markets.

- The Federal Reserve has indicated that they will hold the Fed Fund Rates steady for the near term. This has taken pressure off the bond market, which is evident with the rates across the yield curve falling from 22 -year highs. Looking ahead, the Fed Funds futures market is indicating that there is a rising probability for the Federal Reserve to begin to lower the Fed Funds rate beginning in the middle of 2024 and to have lowered it by at least 1% by the end of 2024.

- Given the relative strength of the economy, longer-term interest rates have risen to align with encouraging economic expectations. For bond investors, reinvestment rates are higher than they have been in over 10 years. Keeping bond portfolios shorter in duration means reinvesting interest payments and maturing bonds into higher yielding bonds which should help total returns for bond portfolios going forward. For bonds in the Alera Dynamic Allocation, we remain slightly shorter in duration than the benchmark because the yield curve has inverted, and we are currently not receiving enough return for the added interest rate risk from the longer-term bonds. We maintain exposure to inflation protected bonds due to persistent inflation. With the odds of an economic slowdown still possible, we have adjusted our bond portfolio toward higher credit quality bond holdings. This includes increasing exposure to mortgage-backed securities which generally have a lower correlation to equities.

Stock market

- The stock market’s reaction to the news that the Federal Reserve may have paused the rising interest rate cycle has been swift and positive. After two years of relentlessly rising interest rates, news that the Fed may finally be done was very welcome. The stock market is driven by the anticipation of future earnings growth. Those future earnings are discounted back to the present to calculate the current value. When rates are rising, the higher discount rate means lower current prices. Once the specter of a rising discount rate is gone, the stock market has more certainty that the current value of future earnings will be more accurate. The stock market prefers certainty to uncertainty. Removing this variable allows the market to focus on earnings growth rather than market valuation corrections.

- While rising interest rates have been a drag on the market, the primary concern for the market continues to be the probability of the next recession. For now, the key economic indicators appear to show the economy growing. The unemployment rate has risen from its historic lows from a few months ago. However, since the initial claims for unemployment insurance are still rather low, the rising unemployment rate may be a positive sign of people coming back into the job market rather than a significant number of people losing their jobs. The recent strikes may also have a small impact on these datapoints as well. For now, the economy is continuing to grow, although not at the pace of the third quarter.

- The US economy has transitioned from the rapid recovery phase to a slower growth phase between 2020 and 2022. With the Federal Reserve prescribing strong medicine in the form of higher interest rates, certain market sectors and the overall economy may have to endure some short-term side effects. In this phase, companies with strong fundamentals, in categories such as consumer durables and health care, can produce consistent earnings and dividends, as well as those bringing innovation and market share dominance in a slower growing economy. Those opportunities can be found in both US and international stocks. For stocks in the Alera Dynamic Allocation, we have shifted to higher quality stocks in both the value and growth categories.

Portfolio strategies

- The Alera Investment Committee continues to monitor the markets and the current economic conditions. Through the Alera Dynamic Allocation process, we have positioned our stock portfolios to emphasize higher quality stocks in both the value and growth categories which may be less susceptible to a slowing economy and persistent inflation across the globe.

- In our taxable and tax-free bond strategies, we remain slightly shorter in duration than the benchmark because the yield curve has flattened, and we are currently not receiving enough return for the added interest rate risk from the longer-term bonds. In less tax-sensitive portfolios, we maintain exposure to inflation protected bonds due to persistent inflation and have increased exposure to mortgage-backed securities, which generally have a lower correlation to equities.

The portfolio for each of our investors is allocated between growth and safety based on their own tolerance for risk in the short run and their desire for growth in their portfolio in the long run. Determining the appropriate asset allocation and risk-reward trade-off is the most important decision that advisors can help with clients. Once determined, the decision about the underlying investments then becomes the focus. Using quantitative and qualitative analysis, we select the most appropriate managers and/or index funds/exchange traded funds for each asset class within each portfolio.