Wealth Services

Weekly Market Update

December 14, 2023

Stocks ripped higher last week on a dramatic retreat in bond yields triggered by easing inflation and a slowing labor market.

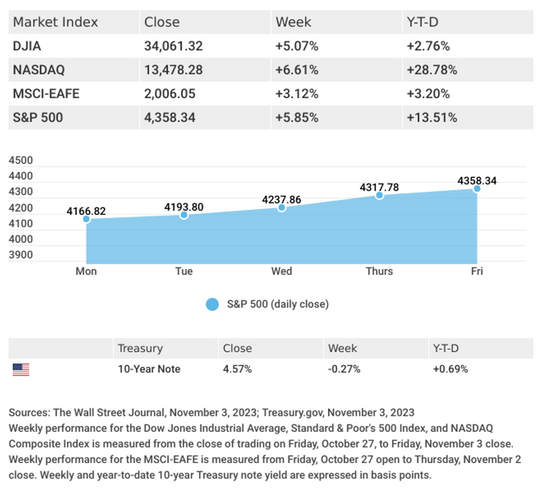

The Dow Jones Industrial Average jumped 5.07%, while the Standard & Poor’s 500 surged 5.85%. The Nasdaq Composite index rocketed 6.61% higher for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 3.12% (sources:1,2,3).

Stocks Rise

Stocks jumped higher right from the start of the week, shaking off the prior week’s sell-off. The combination on Wednesday of the Fed’s decision to keep rates unchanged, which accompanied dovish comments from Fed Chair Powell, and a reassuring Treasury announcement on future bond sales, sparked a third straight day of gains. Slight employment gains and weak manufacturing data provided an additional impetus.

The rally continued on Thursday following a sharp drop in bond yields that was driven, in part, by substantial productivity gains and decelerating wage growth. When Friday’s monthly employment report was lighter than forecast, yields pulled back further, and stocks added to their week’s gains.

Signs Of Labor Cooling

Last week’s employment data showed potential for a cooling labor market after many months of confounding economists’ expectations. The first sign was a lower-than-expected growth in new private sector jobs in October, as reported by Automated Data Processing (ADP), which showed a gain of 113,000 new jobs versus a forecast of 130,000, while job openings were little changed.4

Initial and continuing jobless claims also rose, exceeding consensus estimates. On Friday, the government’s monthly employment report further confirmed a potentially cooling employment picture, showing an October slowdown in hiring (150,000 new jobs versus September’s revised gain of 297,000) and an uptick in the unemployment rate to 3.9%.5

This Week: Key Economic Data

Thursday: Jobless Claims.

Friday: Consumer Sentiment.

Sources

Source: Econoday, November 3, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

Source: Zacks, November 3, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

1. The Wall Street Journal, November 3, 2023.

2. The Wall Street Journal, November 3, 2023.

3. The Wall Street Journal, November 3, 2023.

4. CNBC, November 2, 2023.

5. The Wall Street Journal, November 3, 2023.