About Us

About Us

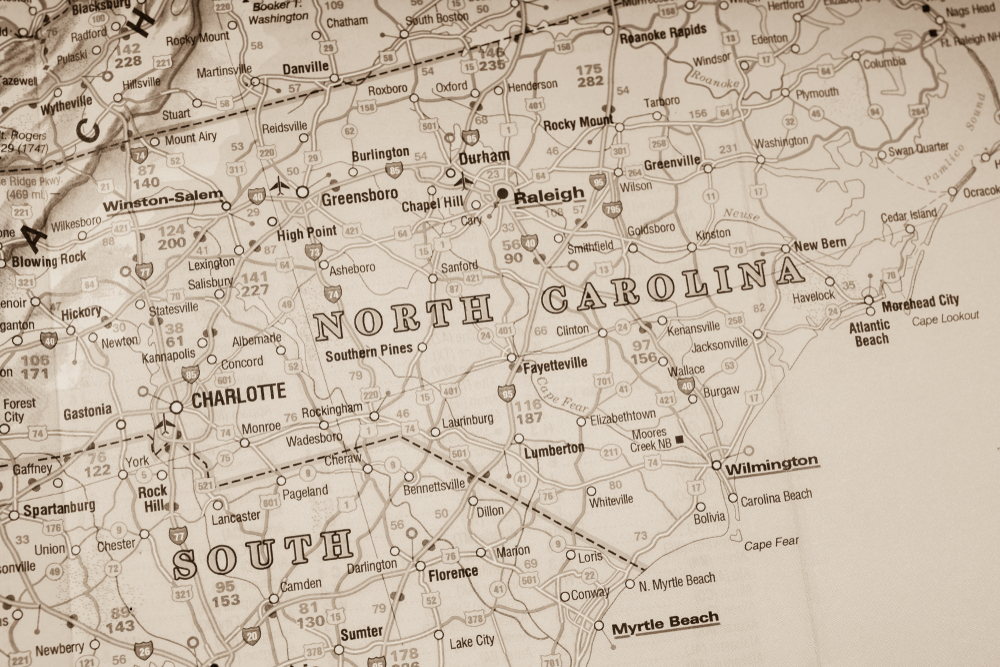

Alera Group Raleigh offices (formerly TriSure and Bagwell & Bagwell) are two of the Triangle's most respected and long-standing insurance firms, each with a rich history of serving the region's businesses and individuals.

The Raleigh team (formerly TriSure) officially joined Alera Group in 2019. The office was founded in 1999, and was one of Raleigh's largest independently owned insurance brokerage and consulting firms. Committed to providing exceptional client service, the team helps local businesses manage property and casualty risks while offering employee benefits with honesty and financial integrity.

In 2021, Alera Group acquired a second Raleigh office (formerly Bagwell & Bagwell), expanding its presence in the Southeast. That office was founded in 1919, representing another of Raleigh's oldest, most trusted insurance agencies. With over 100 years of experience, they've served personal and commercial clients across North Carolina and beyond. For over three generations, the agency has endured and evolved to remain on the forefront in providing risk management and faithfully protecting clients.

Our Guiding Values

From the beginning our core values have guided us in every phase of our business, from the simplest decisions to the most complex. In order of priority, they are:

- Honesty and Integrity

- Superior Customer Service & Professionalism

- Financial Accountability

Our Solutions

From professional liability insurance to employee benefit plans, we offer a full spectrum of policies designed to protect every facet of your business. We have experience not only with every type of insurance, but with an expansive array of industries from Fortune 500 companies to small businesses. Through professional consultation, we’ll learn about your business, its risks and goals, and make recommendations on customized insurance packages.

Business Coverage Solutions:

Comprehensive Business Insurance Solutions Tailored to Protect Your Success

- Aviation Insurance

- Builders Risk Insurance

- Commercial Automobile Insurance

- Commercial Property Insurance

- Crime Insurance

- Directors and Officers Liability Insurance

- Employee Benefit Plans

- Employment Practices Insurance

- Flood Insurance

- General Liability Insurance

- Inland Marine Insurance

- Professional Liability Insurance

- Transportation Insurance

- Umbrella Liability Insurance

- Workers’ Compensation Insurance

Bond Solutions:

Fidelity and Surety Bonds That Protect and Preserve Your Business and Your Reputation

- Financial Institution Bond

- Trustee Bond

- Supply Bond

- Release of Lien Bond

- Payment Bond

- Miscellaneous Bond

- Maintenance Bond

- Injunction Bond

- Guardian Bond

- Fidelity Bond

- Claim and Delivery Bond

- Bid and Performance Bond

- Bankruptcy Bond

- Attachment Bond

- Appeal Bond

- Administrator Bond

- Surety Bond

Personal Insurance Solutions:

The right personal insurance coverage for yourself and your valuable property

- Automobile Insurance

- Boat Insurance

- Flood Insurance

- Homeowners Insurance

- Jewelry Insurance

- Personal Umbrella Insurance

- Renters Insurance

Industries We Serve

Agribusiness, Architects & Engineers, Artisan Contractors, Artisan Subcontractors, Beverages, Boiler & Machinery, Building Services Contractors, Camps, Clean Energy & Technology, Community Associations, Construction, Construction – General Contractors, Country Clubs, Education Institutions, Environmental, Equipment Dealers, Financial Institutions, Financial Services, Food Manufacturers, Franchised Auto & Truck Dealers, Golf Courses, Healthcare, Healthcare Organizations, Hotels, HOA/POA, Imported Products, Life Sciences, Logistics, Manufacturing, Motorsports, Non-Profits, Oil and Gas, Printers, Public Sector Services, Publishers, Real Estate Owners & Managers, Real Estate Developers, Restaurants, Retailers, Small Business, Social Services, Sports, Technology, Transportation, Wholesalers & Distributors.

Resources

Client Payment

Visit https://trisure.epaypolicy.com/ to make a secure payment.

Claims Management

We advocate for our clients and guide them through the claims process. We offer timely, responsive advice and ensure you have a partner to help resolve claims efficiently. Our focus is not just on the financial aspect, but on helping businesses return to normal operations quickly, without unnecessary delays. We also monitor all claims to ensure our carrier partners provide the same high level of service.

During regular business hours, for all lines other than Workers’ Compensation, call our office at 919‐469‐2473. After hours, weekends and holidays and claim emergencies, call directly to your carrier. Visit our contact directory below.

EXPERT EDUCATION

Events and Webinars

Employee Benefits

The Compliance Pathway Q1

Alera Group's quarterly employee benefits compliance roundup will help you stay current on the latest national regulatory developments impacting employers.

March 5, 2026 at 01:00 pm CT | Virtual

Sign Up

Employee Benefits

Alera Group Presents: Navigating Medicare

The knowledgeable team at Alera Group is here to help you navigate your Medicare options to ensure you feel confident in your post-65 healthcare coverage.

March 11, 2026 at 12:00 pm CT | Virtual

Sign Up

Employee Benefits

The Funding Edge: Why Fully Insured Limits Control — and What Modern Funding Unlocks

A funding decision framework leaders can use to evaluate options and align on next steps.

March 17, 2026 at 01:00 pm CT | Virtual

Sign Up

THOUGHT LEADERSHIP

Insights

Employee Benefits

Legal Alert: RxDC Reporting Due June 1st

Reminder: RxDC Reporting Due June 1st

February 26, 2026

Find out moreProperty and Casualty

AI-Powered Cyber Attacks, Why Yesterday’s Defenses Aren’t Enough.

The widespread availability of AI technology, combined with the ease of manipulating video calls, makes phone and Zoom calls susceptible to exploitation by threat actors.

February 2, 2026

Find out moreEmployee Benefits

IRS Releases Guidance Related to Recent HSA Changes

The IRS recently released Notice 2026-5, which provides guidance and answers to common questions related to the expanded availability of health savings accounts (“HSA”) under the Reconciliation Act (previously named the One Big Beautiful Bill Act) passed into law earlier this year.

December 30, 2025

Find out moreProperty and Casualty

Are you prepared for 2026? Property and Casualty Trends Uncovered

The sixth annual Property and Casualty Market Outlook from Alera Group sets the stage for how organizations can recalibrate their risk strategies in 2026. Built on thousands of data points — including a nationwide survey of insurance company partners and wholesale intermediaries — this report delivers actionable insights for insurance buyers, risk managers and business leaders.

December 17, 2025

Find out more