Meet Our Team

Christine Brown, SHRM-CP®

Executive HR Services Partner & Lead Recruiter

Christine helps Alera Group clients optimize long-term talent acquisition through solid recruiting strategies and powerful tools, empowering them to consistently attract the right candidates. This goes beyond assessing skills and qualifications, because it’s also vital to find employees who align with the values and mission of the organization.

A cum laude graduate of the University of Alaska Anchorage, Christine spent 15 years as an HR manager with Nordstrom before joining our team. She has earned the SHRM Certified Professional (SHRM-CP®) designation and is active in leadership for the Anchorage chapter of SHRM.

When Christine isn’t helping clients recruit more effectively, she enjoys hiking, Pilates, and spending time with her family. She also volunteers with United Way and Clare House of Anchorage.

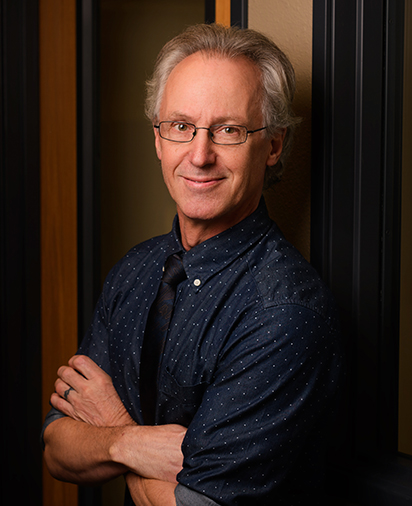

Ron Devon, CPFA

Sr. Account Manager, Retirement Plan Services

Ron has a business background that spans more than a quarter-century—as a small-business owner for 20 years, he worked with investors and provided financial planning services before joining the team as an Account Strategist in 2015.

Ron’s deep understanding of the concern’s small businesses face, along with his vast experience on both the employer and investor sides, allow him to effectively build long-term retirement strategies for our clients and develop plans that meet each organization’s unique needs. A graduate of the University of Alaska with a degree in chemistry,

Ron describes himself as a “numbers guy”; he holds Series 7 and 66 licenses from the Financial Industry Regulatory Authority and is a registered Investment Advisor Representative. He has also earned the Certified Plan Fiduciary Advisor (CPFA) designation.

When he’s not focusing on the numbers with clients and their employees, Ron is often out on the water, enjoying the sights of Alaska from his sailboat.

Investment advisory services offered through Alera Investment Advisors, LLC. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

Tiffani Gutierrez, BBA, SHRM-CP®, THRP

HR Services Partner

Drawing upon her expertise in managing and enhancing benefits programs, including federal employee health benefits, Tiffani ensures our strategies are tailored to meet the unique needs of our clients. She has a particular passion for working with tribal organizations, as well as mentoring junior team members to help them grow professionally.

Tiffani’s diverse background includes experience in financial services, property management, and healthcare—in addition to serving in the Alaska Army National Guard. She is a cum laude graduate of the University of Alaska Anchorage, where she earned a degree in business administration, and has also achieved the SHRM Certified Professional (SHRM-CP®) and Tribal Human Resources Professional designations.

Originally from Anchorage, Tiffani now lives in Princeton, Texas, with her two elementary-age sons. In addition to spending quality time with her family, she loves travel, learning about different cultures, home design, remodeling, and solving jigsaw puzzles.

Sabrina Peterson, CFP®, AIF®, CPFA

Sr. Advisor, Retirement Plan Services

Fueled by her engineering background, Sabrina provides a highly analytical approach for clients, combining technical knowledge with a conscientious nature. She enjoys finding effective approaches and innovative solutions for retirement plan trustees, investment committee members, and employees participating in their company’s benefit offering. A key professional goal, she says, is helping Alaskan businesses succeed at attracting and retaining talent.

Sabrina earned an MBA in global finance at Alaska Pacific University to go with her chemical engineering degree from California State University Northridge. She also holds general securities and insurance licenses from the Financial Industry Regulatory Authority and state boards and continues to broaden her skills—achieving the Certified Financial Planner (CFP®), Accredited Investment Fiduciary (AIF®), and the Certified Fiduciary Advisor (CPFA) designations.

Before joining the team in 2009, Sabrina was a consultant specializing in 401(k) and 403(b) retirement plans for Financial Resources, Inc., and worked as a broker for Merrill Lynch.

Investment advisory services offered through Alera Investment Advisors, LLC. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

EXPERT EDUCATION

Events and Webinars

Employee Benefits

Navigating Medicare

The knowledgeable team at Alera Group is here to help you navigate your Medicare options to ensure you feel confident in your post-65 healthcare coverage.

February 11, 2026 at 12:00 pm CT | Virtual

Sign Up

Property and Casualty

Top Cyber Threats of 2026 – and How to Mitigate Them

Cybercriminals have a new playbook—your business could be next.

February 17, 2026 at 01:00 pm CT | Virtual

Sign Up

Employee Benefits

Designing Benefits for Mid - to Late-Career Employees

In our three-part webinar series, Designing Benefits That Work – A Data-Driven, Multigenerational Focus, we’ll explore multigenerational workforce insights, debunk generational myths, share early- and late-career benefit strategies, review legal and compliance trends, and provide actionable tools and resources.

February 18, 2026 at 10:00 am CT | Virtual

Sign Up

THOUGHT LEADERSHIP

Insights

Property and Casualty

AI-Powered Cyber Attacks, Why Yesterday’s Defenses Aren’t Enough.

The widespread availability of AI technology, combined with the ease of manipulating video calls, makes phone and Zoom calls susceptible to exploitation by threat actors.

February 2, 2026

Find out moreEmployee Benefits

IRS Releases Guidance Related to Recent HSA Changes

The IRS recently released Notice 2026-5, which provides guidance and answers to common questions related to the expanded availability of health savings accounts (“HSA”) under the Reconciliation Act (previously named the One Big Beautiful Bill Act) passed into law earlier this year.

December 30, 2025

Find out moreProperty and Casualty

Are you prepared for 2026? Property and Casualty Trends Uncovered

The sixth annual Property and Casualty Market Outlook from Alera Group sets the stage for how organizations can recalibrate their risk strategies in 2026. Built on thousands of data points — including a nationwide survey of insurance company partners and wholesale intermediaries — this report delivers actionable insights for insurance buyers, risk managers and business leaders.

December 17, 2025

Find out moreEmployee Benefits

Legal Alert: Agencies Clarify How Certain Fertility Benefits May be Treated as Excepted Benefits

This alert is of interest to all employers that offer fertility benefits or may be interested in offering fertility benefits in the future.

November 4, 2025

Find out more